- Hello!

“Tell me, what are some of the things you aren’t good at or that you need to work on”. I froze. My internal monologue was racing quickly.

I was interviewing at my dream company, and I didn’t know how to answer. It had been at least four years since I had done a job interview. Why didn’t I think through a better answer to this question? The seconds felt like hours. I felt like I was spiraling out of control trying to think how to answer this … Should I give them my real development opportunities? They won’t hire me if I tell them what I stink out, right? Do I tell them about something that used to be a weakness, but I turned it into a strength … ugh …

In the end, I was sheepishly able to articulate a couple things I felt I could do better and, in the end, I managed to get an offer for the job (I didn’t end up taking it, long story…)

The reality is, interviews are a fact of life in FP&A and corporate finance. Like anything, the more you prepare, practice, and actually go through the interview process … the better you will be!

Throughout my career, I have interviewed for new roles regularly, even if I did not anticipate taking a new job, just to keep my skills sharp (you do have to be a bit careful with this, especially as you get more senior, because you don’t want to burn any bridges with companies/recruiters).

It pays to practice, but you also have to approach the interviews the right way and understand what interviewers are really looking for.

In this article, I am going to take you through

some general do’s and don’ts for interviews

common pitfalls I see in interviews

common questions in FP&A interviews, why they are asked, how to answer, and what the company is looking to learn

how to approach it when they ask you what questions you have

We also have this content available on our youtube channel, if you prefer to listen/watch rather than read, check out the video below:

It’s tempting to tailor your answers to what you think the interviewer wants to hear. However, most interviewers can see through this. Aim to provide honest responses.

If you can’t acknowledge your development opportunities or weaknesses, it might signal to the interviewer a lack of self-awareness or an inability to accept and use feedback.

Research extensively about the company, industry, competitors, etc. This is easier with public companies but still achievable with private companies/start-ups through various sources like interviews, news stories, websites, LinkedIn, etc.

For public companies:

Read the 10-K and 10-Q reports, especially the Management’s Discussion and Analysis (MD&A) section.

Listen to the last few earnings calls, focusing particularly on the Q&A session.

Familiarize yourself with high-level financials, key executives (CEO/CFO), main products, reported segments, major locations, and ongoing initiatives.

Review the company’s website for any additional information.

Review potential interview questions and create bullet points for your answers. Aim for honesty, not scripted responses.

It’s noticeable when interviewees are simply recalling memorized answers. It’s better to be natural and genuine in your responses.

Strive for a conversational tone during the interview and have a long list of questions ready. This approach can make the interview feel more engaging and less formal.

Always send a thank-you note as soon as you get home. I would aim to send within 24 hours of the interview, you never know when they will meet to discuss candidates. A thank you might be a tie-breaker type item when they are reviewing candidates!

One final “do”. Do overdress slightly, you never want to underdress. This depends all depends on the company, the position, and so on. But I always aim to overdress slightly. If it’s business casual, I throw on a blazer.

These do’s and don’t should give you a good general framework for how to approach an interview and how to prepare. I think it is also good to talk about roads to avoid. Here is my list of the five most common ways I see interviews send candidates resumes straight into the garbage can after the interview!

Lack of Authenticity: Not being genuine can be a significant drawback.

Inability to Describe Personal Contributions: Ensure you can articulate what you specifically have done or can do. Balance the use of “we” and “I”, but be clear about your own role and actions. (I talk more about this below in the Q&A section)

Appearing Arrogant or Too Perfect: Overconfidence or the portrayal of perfection can be off-putting.

Lack of Enthusiasm for the Opportunity: It’s crucial to show genuine interest and excitement about the job and the company.

Not qualified: Often this comes through because they can’t describe their personal contributions (second bullet above). But sometimes people make it to the interview process when they really aren’t qualified and/or don’t have the technical or leadership skills needed.

These may sound simple and maybe even silly, but these are the most common reasons. As you prepare, keep these in mind and think through if you are triggering any of these red flags!

Now it’s time to get into the questions you may get asked in an FP&A or corporate finance interview. I’m splitting these up into different question “groupings” Questions are wide ranging and really do depend on the job, the company, the individual interviewer, and more!

These are questions that try to asses your financial skills, your FP&A skills, and so on.

Can you explain the difference between the income statement, balance sheet, and cash flow statement, and how they interrelate?

What’s the difference between Cash vs Accrual accounting?

How do you approach creating a financial model, and what steps do you take to ensure its accuracy and reliability?

What is a DCF model, and can you walk me through how you would construct one?

How do you determine the cost of capital for a project, and why is it important?

What methods would you use to analyze whether a project is financially viable?

Can you explain the concept of variance analysis (income statement, cash flow statement, and balance sheet) and how you use it in FP&A?

They want to see if you have the financial knowledge and technical skills that are needed for the job. Do you understand financial planning & forecasting, financial reports, financial performance, financial modeling, etc.

Depending on the company, you may even find they get more technical to assess specific financial topics (cash flows, working capital (accounts receivable or accounts payable management). Can you look at financial statements and gauge a company’s financial health? This also shows them your ability to communicate financial concepts in a way that is easy to understand.

First off, you need to answer them correctly! But you also want to do it in a way that doesn’t sound like you plugged a question into Chat GPT and got the answer. Don’t sound like a robot! Be able to explain these in your own words and ideally you could even infuse a quick example (like how you use NPV and Payback to analyze a new project you worked on in your current role).

This is really the most common interview question. It’s basically the question of what are your strengths and weaknesses. It can be asked in many different forms, but they all aim to get to the same thing.

How would your peers/former bosses / coworkers describe you… what do you do well, what don’t you do well?

What are some words they would use to describe you?

What do you do well? What don’t you do well?

What are your biggest assets / Strengths? What areas do you need development on?

An interviewer is trying to determine if you are self-aware. Can you actually sit back and know what you are good at and what you need to work on. This tells them if you can take feedback (and if you seek out feedback). They do also want to get a feel for if your strengths line up with the role.

Truthfully and with a very slight slant toward the role.

You want to give them some of your real strengths You may even pair one of your strengths with a with very concise example that supports it.

You should also give two real development opportunities you have and you should mention you are aware of the opportunity and give a quick comment about how you are working to improve those areas. Avoid the temptation to say you have ‘fixed’ it. Say you are working to be better

What I mean by a slight slant toward the role is … If you are an FP&A person and you have trouble with attention to detail, maybe don’t bring that up as a weakness. That is a red flat (just fix that attention to detail!).

These are projects where they want to hear about something you worked on.

What project are you most proud of?

Tell me about a project you worked on where you made an impact?

Tell me about a time you added value?

They want to see specifics of where you have added value. They want to see if you can summarize and communicate a big project. They want to understand if you yourself add value and contribute. This often also enables them to see if you are a self-starter and how you work in a team.

You should answer with a real example of a project you are proud of where something was accomplished. Ideally you start with why you started the project. Why it was important to the businesses. Then you get into how you approached the project, what you actually did, and what the end result was.

Hopefully you have a handful of real examples of things you worked on that actually helped things. Maybe it saved the company money? Maybe you caught an error? Maybe you fixed a process? Maybe you automated something? Maybe you gave the sales team something they really needed? Maybe you worked on a special project? what do you think? Why are you a fit?

It is also good if this aligns with your strengths (if you already got that question)

These are questions that can be behavioral or specific to a problem/project.

How do you communicate financial information to people who may not have a financial background?

Tell me about a time when you had to persuade your team or management to do something. How did you approach this, and what was the outcome?

What has been the most challenging project you have been on … or where you had a teammate you disagreed with, and how did you handle the uncertainties involved?

Describe a time when you had to take financial data (maybe even specifically incomplete data) and you use it to inform decision making. How did you ensure your recommendations were sound?

Can you give an example of a time when you identified a significant financial risk or opportunity in the company’s data? What action did you take?

They want to see if you can address problems. To see how you apply your skills and show initiative. These often are geared toward obstacles you encounter (whether it be with another person or with a hurdle in the project itself). These questions, as do many, also require good communication skills and other soft skills to get your point across.

You want to have examples at the ready for different situations. If possible, it’s great to follow a formula like this:

Discover a problem or gap somewhere (internal and external challenges both could apply!)

Develop a plan to approach it

Encounter a hurdle … overcome that hurdle

Show a quantifiable result that makes an impact

These are questions that are very specific to the role itself

Are you proficient with any financial analysis software or ERP systems? Can you provide examples of how you’ve used these tools in your work?

How do you ensure the integrity of the data you use in your analyses?

Have you used or have experience with X, Y, Z?

They really want to know if you have experience with these specifics, but they are also gauging to see your ability to learn them and how long they think your learning curve would be.

There are certain tools you should know how to use in Financial Planning and Analysis. Examples would be: a reporting tool, an ERP, Excel/Sheets, etc) You may not have used all the systems at the company you are interviewing with, but you want to emphasize that you have utilized different ERPs and know how they function and can learn a new one.

For example, you maybe haven’t used Tableu, but you’ve used a different visualization tool and feel confident you can learn another one.

It’s most important to:

show you have a grasp on tools (ERP, visualization, excel, and others that could help (PowerBI, PowerQuery, SQL, etc)

show an attention to detail and a drive to ensure data is correct, ties, etc

that you can extract and manipulate data

These are broad questions to learn about you.

What do you enjoy most about working in FP&A, and why do you think it’s a good fit for your skills and interests?

What do you like to do outside of work?

They want to see if you will fit with the finance team. They also are trying to see if you have interests / are an interesting person. To some extent, do they like you…

Give a real answer. If you are going to say you like to read, be ready for them to ask you for a recommendation. If you say you like movies, the same. If you say you like to workout, be ready to talk about what type, etc. Don’t get caught in a white lie.

When I am on the other side of the table conducting an interview, I always leave time for the candidate to ask questions. As you do your interview, you will almost always be given the chance to ask your questions back to the interviewer.

This is a great opportunity to shine and can often differentiate you vs your competitors! In interviews, as in boxing, you want to make sure you finish stronger than you started!

I view this interview as a two-way interview. They should get the chance to ask me questions about the job, the company, my management style, or anything else.

The questions a candidate asks tells me about them. How interested are they? Did they do any research before coming into the interview? Do they refer back to something earlier in the conversation?

One thing that almost eliminates a candidate from contention in a role is when they ask one simple question and then tell me that’s all they had! I think to myself, “WHAT?!?!?! You have done multiple rounds of interviews, you blocked time to do this interview, and you don’t have any questions!”

I immediately assume they either (1) aren’t that interested in the role or (2) didn’t prepare enough to ask questions (3) are the type of person that only does the bare minimum.

So NEVER fall silent here. If time runs out, that is one thing. But here is a suggestion of what to say if time is running short. “I do have more questions, but I want to be respectful of your time and I know we are just about at the end of our schedule hour. Do you have time for a couple more questions?”

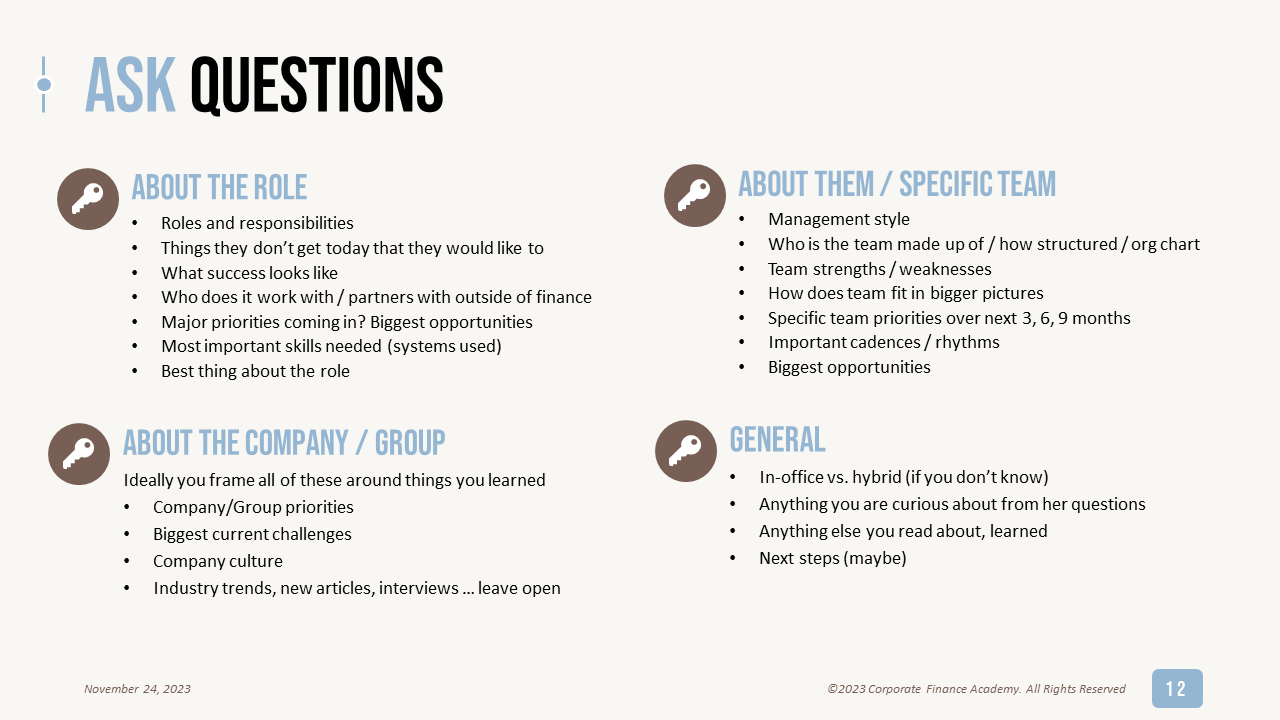

So, what questions should you ask? This truly doesn’t have to be has hard as you might think. I will break the potential questions in a few buckets

I think of this in two buckets (1) you could make the interview more conversational and ask questions along the way as time allows or (2) refer back to something you previously discussed earlier in the interview

Let’s say earlier in the interview they asked about Tableau. You might say, “Earlier you mentioned Tableau, is that the primary tool you use for data visualization / reporting? Could you elaborate a bit on the tools most frequently used?”

These questions show that a candidate was engaged and paying attention. Additionally, if the interviewer mentioned something specifically, there is a good chance it is important to them and your question may resonate well with them.

When a candidate demonstrates they spent time researching a company, it usually reflects favorably on them.

This could take many shapes, but here is one example:

In doing your research, you see in the headlines that the company you are interviewing with got a new CEO or CFO about a year ago. You could ask if there have been any cultural changes or new priorities in the company with the change in leadership.

Another example:

The company you are interviewing with is a supplier to the major players in the auto industry and you see that the United Auto Workers just signed a new union contract with Ford and General Motors. A good question (depending on the company) might be, “Will the recently signed UAW contracts have any impact on your pricing with Ford and GM, or do you anticipate similar labor cost challenges will hit you?”

The first two buckets are often superior questions to ask because they showcase how you connect dots, proactively prepare, and show insight. I call the rest of the questions “standard questions’ because you don’t really need to know a ton about the company you are interviewing with to come up with these.

Below is an image that lists out a framework for how you can come up with questions. These may be things like, “Who both within finance as well as outside of finance does this role partner with or support?”, “What are the biggest priorities for the FP&A team over the next 6-12 months and how does this role fit in to that?”.

Approaching an interview doesn’t have to be complicated, but will take a little time. Always prepare, know your do’s and don’ts, have a realistic (but not overly negative) self-assessment, have questions ready to ask, and send a thank you within 24 of the interview.

Remember, a job interview should be “two-way” you should be trying to get the role, but also very seriously seeing if the role is a good fit for you!

I’ve learned a hard lesson from taking a job that I could tell might not be quite the right fit (just because I felt like I needed a change and it was a big promotion / title advancement).

Unless you are on the edge of personal bankruptcy, don’t go into a role where your spidey sense is telling you it might not be ‘the’ job. When I talk to people who already have a job, but are looking for something I remind them that they aren’t choosing between the job they already have and the one they are interviewing for … but between their current job and all the other potential jobs.

More jobs will come along. Keep working hard. Keep preparing. All these interviews are great practice. Learn from each one and you will keep getting better.

Good luck!

I will add much more color here soon, but here is draft 1 of my FP&A Salary calculator. I will also add the methodology for

Here we go! As part of our ongoing series “A Week in the Life” where we give you a real glimpse into the life of

Technically, all finance jobs at any corporation is could be called corporate finance. You could say investment banking, financial planning, and anything related to finance