- Hello!

Hey everybody, welcome back to the Corporate Finance Academy! Today, we’re going to dive into the world of the cash flow forecasts. This is a game-changer for businesses, and I’m excited to break it down for you.

In my 20 years in finance, I have a ton of experience building cash flow forecasts. I have used both the direct method and the indirect method… but a 13-week forecast based on actual dollars in and dollars out is the best way to make sure you can meet your debt service payments, your payroll, and you stay solvent as a business.

We’ll cover everything from what it is and how to build it, to why it’s crucial and the benefits it brings. Get ready to take control of your cash flow!

Listen up, my friends! Cash is and always has been king in the business world. You can have a killer business with crazy revenue and fat profits, but if your cash flow ain’t right, you’re screwed.

That’s where the 13-week cash flow forecast comes in. It’s like your check engine light, telling you if everything’s running smooth or if you’re about to blow a gasket.

In today’s wild economic climate, this isn’t optional anymore—it’s a must-have for any business to avoid financial distress.

I know many of you reading this are in FP&A or Accounting and probably got asked to create this.

This article should give you a foundational knowledge of why you were asked to build a cash flow model, what a template for what a week by week cash flow model should, and give you the tools to get started.

If you are more of an active learner, check out our video on the 13 week cash flow model

So, what’s the purpose of this bad boy? Let me tell you. The 13-week cash flow forecast is the secret weapon that answers the most important questions in your business. We’re talking:

Can you make payroll and pay your awesome employees?

Will you have enough moolah to tackle your long-term debts?

How much cash is sitting pretty in your bank, and does it mess with your investment plans?

Can you invest in that sweet inventory to fuel your growth, or do you need to hustle for financing?

Are you ready to expand your workforce and pay those extra salaries?

Want to unleash a marketing campaign to dominate your market? Well, do you have the cash to pay your marketing vendors?

Do you need to push out payments or secure more credit to keep your cash flow pumping?

These questions are just the beginning, my friends. A good 3-month cash forecast gives you the insights to make killer decisions and run your business smoothly. It should also give you visibility and insights to improve your cash conversion cycle.

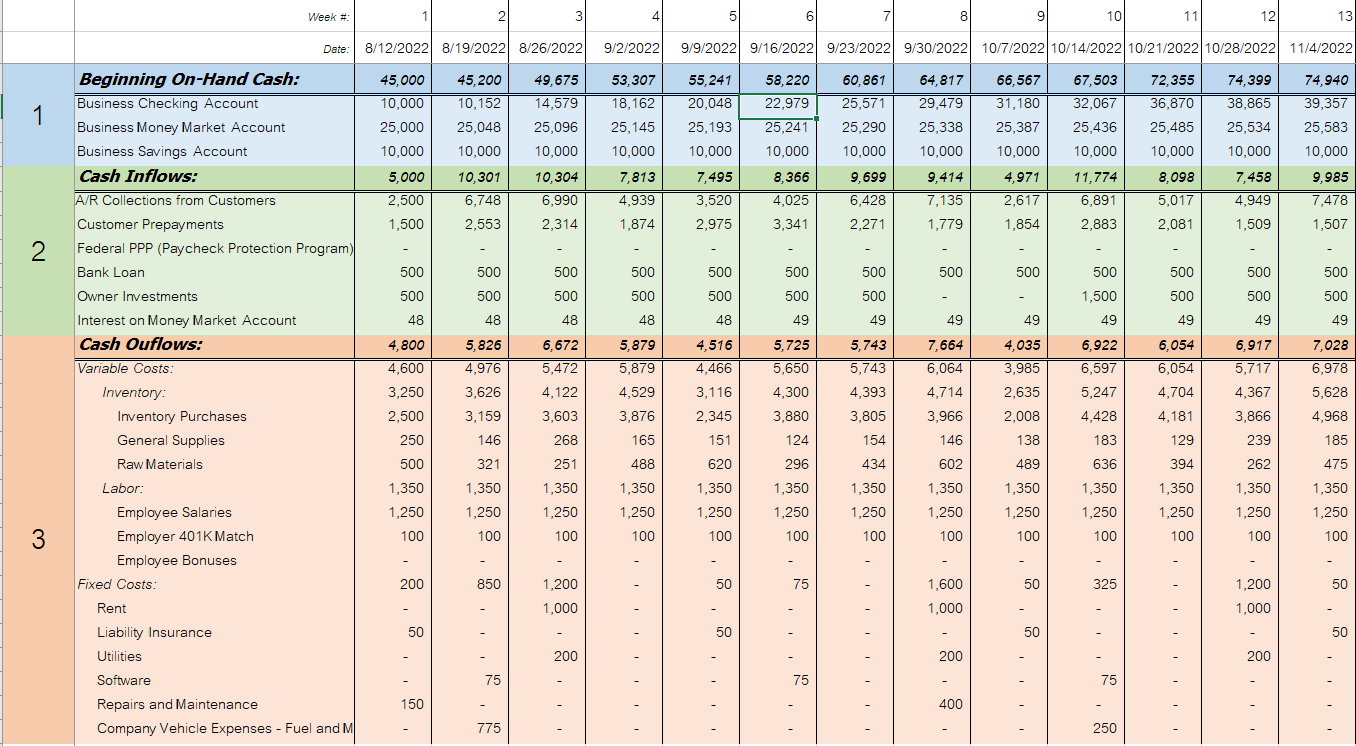

There are three main elements to this relatively simple financial model. You have the cash you start with, your weekly cash receipts, and your weekly cash disbursements.

Let’s briefly go through each of these elements and how to build this thing and dominate the cash flow game. You have to focus on these three buckets:

Cash on hand: This is the cash you have right now—money in the bank, baby! It’s the green stuff you can use to tackle any unexpected expenses that come your way. You may have one bank account or you may have 20. This is our starting point.

Cash Inflows or Cash Receipts: This is the sweet cash flowing into your business. It’s all about projecting the money you expect to receive in the current week and the next 13 weeks. We’re talking customer payments, investor contributions, loans, interest income—anything that fills up your bank account.

Cash Outflows: Time to tackle the cash flowing out of your business. This section includes all the expenses you gotta handle—rent, utilities, payroll, inventory, marketing costs, and those vendors who keep your business moving.

Visualize Your Cash Flow Dominance: Now, I want you to imagine a killer template that lays out your 13-week cash flow forecast like a king or queen of finance. It shows your starting cash, the cash rolling in, and the cash going out.

This is just an example of a simple model. If you work in a big business you may also have to have different divisions all complete one of these, then you will have to consolidate for an overall picture!

One of the first rules of a cash flow forecast is that ‘garbage in’ will result in ‘garbage out’. Meaning, if you don’t fully understand the cash flows of your business or you don’t understand your business operations and how they impact cash, then you will not have an accurate forecast.

A cash forecast is iterative and perfection is the enemy of progress. You will have to continually refine and improve your forecast. You have to refine each line item of the cash inflows and cash outflows. Some line items are consistent like how much you pay in rent, but some can be more difficult like your A/R collections from customer because you don’t control when they pay you!

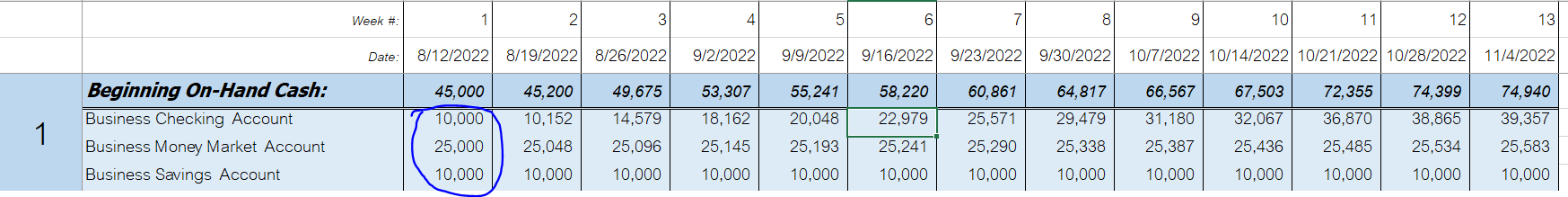

First you start with the cash you have on hand at the start of the 13-week period. For “Cash on Hand” that is the only time you have to input something, the rest will just be math carrying forward your inflows and outflows. The circled numbers in the image belowwould be your only input.

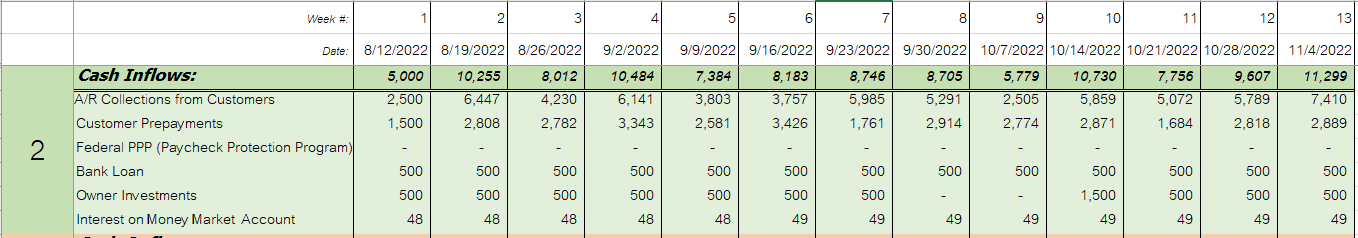

Next up, is cash inflows. Here you will forecast your weekly receipts. The most common and typically largest inflow is accounts receivable.

A/R just happens to also be a difficult item to forecast. We will talk more about forecasting accounts receivable below.

Below you can see an example of what the cash inflows section of the template will look like:

It is so hard to forecast accounts receivable for so many businesses because you rely on other people to pay you, and it is difficult to know when that happens.

There are a few common way to forecast accounts receivable. We aren’t going to go into depth on how to do each one of these, but we will write articles in the future to help! Here are a couple approaches you could use:

Age out each receivable. This is a detailed roll-up by customer based on their terms. You take sales to that customer and roll them forward to when you expect to be paid (usually based off of their payment terms or historical data that shows their average Days Sales Outstanding).

Simple averages… In this example, let’s say your average payment terms are 30 days, you would just assume one week of sales becomes your cash receipts in 30 days.

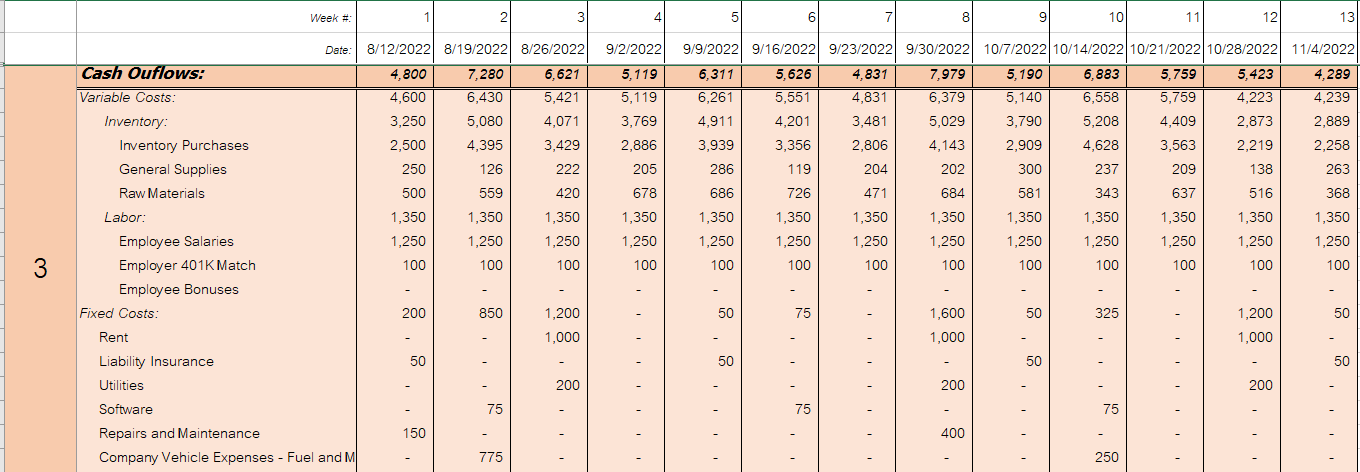

Depending on your business, you could have a HUGE number of different cash outflows from your business.

A business pays for supplies, utilities, employees, the list goes on and on. Every one of those payments are cash disbursements out of your bank account (or on credit).

We could write a whole article (and we might) on understanding your cash payments going out the door. However, in this article I just want to make a few points about forecasting your cash outflows

It is important to understand the full landscape of your cash outflows. There needs to be good communication within your business for one-time or non-standard purchases of materials, or payments to employees, or tax payments. These are cash outflows that often throw off a cash forecast.

The great thing about cash outflows is… you control them! Many businesses only make payments one day per week so it is more predictable. Just remember, at some point, you have to pay those bills!

Below is what the Cash Outflows section of the weekly cash flow forecast might look like:

This thing is your ultimate financial weapon, helping you:

Monitor Cash Health: It keeps you on top of your cash game, showing you where you stand and if any red flags are waving. You should be able to use this as a tool to understand your cash conversion cycle and start to build an improvement plan.

Spot Pressure Points: No surprises here! The forecast highlights potential cash shortfalls and risks, so you can hustle and take action before things go south.

Drive Performance: Regularly analyzing this forecast helps you boost cash collections, optimize your working capital, and level up your overall business performance. Get ready to dominate, my friends!

Take Control: By comparing your actual results with the forecast, you take control of your cash flow like a true champion. You spot leaks, fix issues, and ensure your financial hustle is on point. Always review your actuals vs what you thought, refine, and improve.

My fellow finance nerds, the 13-week cash flow forecast is your key to financial domination. It’s time to take control of your business finances, make good decisions, and hit your budgets.

Don’t sleep on this tool—it’s a game-changer. it is also a tool that is critical to have in your cash management tool belt.

Every FP&A leader, CFO, and Controller, needs to have this skill sharp. Even if you haven’t had to create a 13-week forecast yet, you should learn how to.

If you want to start to learn to build financial models, understand teh financial statements, get better at Excel, and just level-up your FP&A, finance, and accounting skills today… Get started with our Corporate Finance Academy Subscription!

Before we get into the details of different sales forecasting methods, I want to tell you a story! But first… for those of you who

If you work in Financial Planning & Analysis or Corporate Finance, you most likely will have to develop a revenue forecast at some point. the

If you want to be successful in corporate finance, there are certain corporate finance fundamentals that you need to develop in your first few years